David T. Drummond ⎜Jul 17, 2019 ⎜ Company

isoSolutions was very pleased to welcome to its Vancouver office a visitor from the Abetavu children’s home in Uganda. Abetavu is a charity that isoSolutions has supported for several years. Our visitor from Abetavu – Ms. Tinah Praise – entered the Abetavu home in Uganda when she was 9 year old. She is now entering her second year of college in Kabale, Uganda.

Abetavu is an organization that started as an orphanage, founded by a Vancouver woman, Carli Travers, and her Ugandan husband Robert, nearly ten years ago. It is now so much more than an orphanage. Abetavu provides a safe haven to children that need support, and it provides essential services to the local community, in terms of counseling, education, sports, and many other services. Tinah is so grateful for having a chance at an education, something none of her other ten siblings were able to have. (more…)

Tags: Global isoSolutions Philanthropy

Kevin Yang ⎜Sep 6, 2018 ⎜ Industry

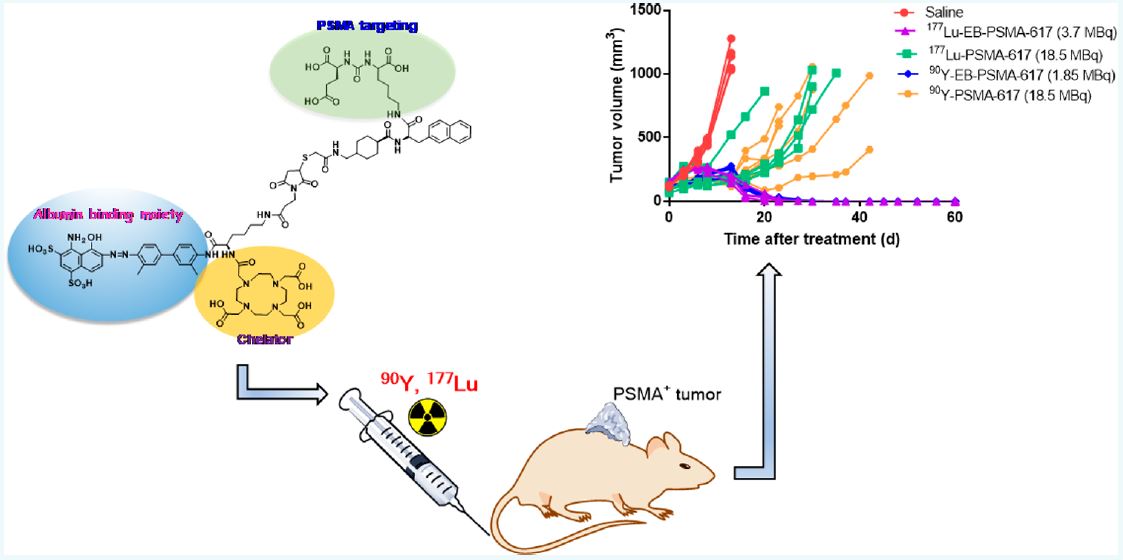

Prostate cancer is the most frequently diagnosed malignant tumor in men worldwide. Prostate-specific membrane antigen (PSMA) is a surface molecule specifically expressed by prostate tumors and has been shown to be a valid target for internal radionuclide therapy in both preclinical and clinical settings. The most common radiotherapeutic agent is the small molecule 177Lu-PSMA-617, (more…)